Chelsea Slip and Fall Lawyer

Injured in a slip and fall accident in Chelsea? DiBella Law Offices is here to help you pursue the compensation you deserve, ensuring property owners are held accountable for unsafe conditions.

Get Free Advice About The Compensation You Deserve

Home » Chelsea Personal Injury Attorney » Chelsea Slip and Fall Lawyer

Reviewed by: Christopher DiBella

March 25, 2025

Slip & Fall Accidents in Chelsea

Although Chelsea is the smallest city in Massachusetts with a total area of 2.46 square miles, it’s certainly not a ghost town; it’s actually ranked as Massachusetts’ second most densely populated city.

Bordering the Mystic River, Chelsea offers many beautiful day outings with more than 10 community parks, the most popular including Bellingham Hill Park and Mary O’Malley State Park. In the past few decades, infrastructure has boomed in the city with the development of Mystic Mall as well as many new businesses, restaurants, and stores.

Wherever you are in Chelsea, whether visiting a home or the park, enjoying a meal or shopping, owners have a duty to take reasonable steps to keep you safe. If you suffer a slip & fall accident on another person’s property, and the owner is at fault, you may be able to seek compensation from the owner in a premises liability case.

If you sustained injuries in a slip & fall accident in Chelsea, schedule a free consultation with DiBella Law Injury and Accident Lawyers today at (978) 396-2464 for outstanding legal advice and representation.

Where and How Slip & Fall Accidents Happen

Slip & fall accidents are common and can give grounds to a premises liability case. Slip & fall accidents are more common in certain locations, including malls and shopping centers, restaurants, gas stations, work places, and at public parks and playgrounds. However, this type of accident can happen anywhere, and can be caused by a number of factors.

In some cases, a slip or fall may be the fault of the person who suffered the accident, for example if the person was distracted or tripped on their clothing or shoes. Where this is the case, even if the accident was on another person’s property, the injured party can’t seek compensation from the owner. To receive compensation, the owner must be at fault for the accident in some way.

Examples of how an owner can be liable for a slip & fall accident on their property include the following:

- Spills or leaks that aren’t cleaned up

- Slippery surfaces/tiles

- Poor lighting

- Insufficient handrails on stairs

- Broken staircases

- Unusual obstructions or debris

- Uneven surfaces or pavements

We’ve offered crucial support and guidance to individuals who have suffered injuries, ensuring their financial and emotional well-being.

Injuries from Slip & Fall Accidents

Slip & fall accidents may not seem serious when compared to other potential premises liability accidents such as fires, elevator accidents, or ceiling collapse. However, slips and falls have the potential to cause serious, life-altering consequences.

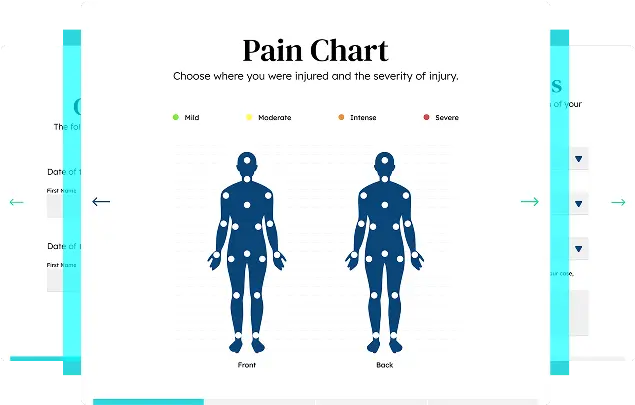

While some people may come out of a slip and fall relatively unscathed, suffering only minor injuries such as bruising, cuts or pulled muscles, slip & fall accident victims can suffer drastic consequences. Serious slip & fall accidents can cause traumatic brain injuries, neck or spinal injuries, breaks or fractures to various parts of the body, and severe lacerations or wounds.

After the accident, a Chelsea personal injury lawyer can help to prove the owner’s liability by investigating the ultimate cause of the incident using evidence such as witness statements, CCTV footage, or expert investigations.

Get immediate case evaluation with no cost or obligation to you in less than 5 minutes.

We Can Help You Today

DiBella Law Injury and Accident Lawyers boasts one of Massachusetts’ top attorney teams which drastically increases the chances of your premises liability case succeeding when legal action is warranted. When successful in court, an injured party can receive compensation for a variety of losses, including medical bills, out-of-pocket expenses, lost wages, pain and suffering, and loss of enjoyment.

If you were hurt in a slip & fall accident in Chelsea and believe the owner may be at fault, DiBella Law Injury and Accident Lawyers can establish whether grounds for legal action exist, and fight passionately for your right to favorable compensation. Call us today at (978) 396-2464.